Breaking News! We are Relaunching Soon

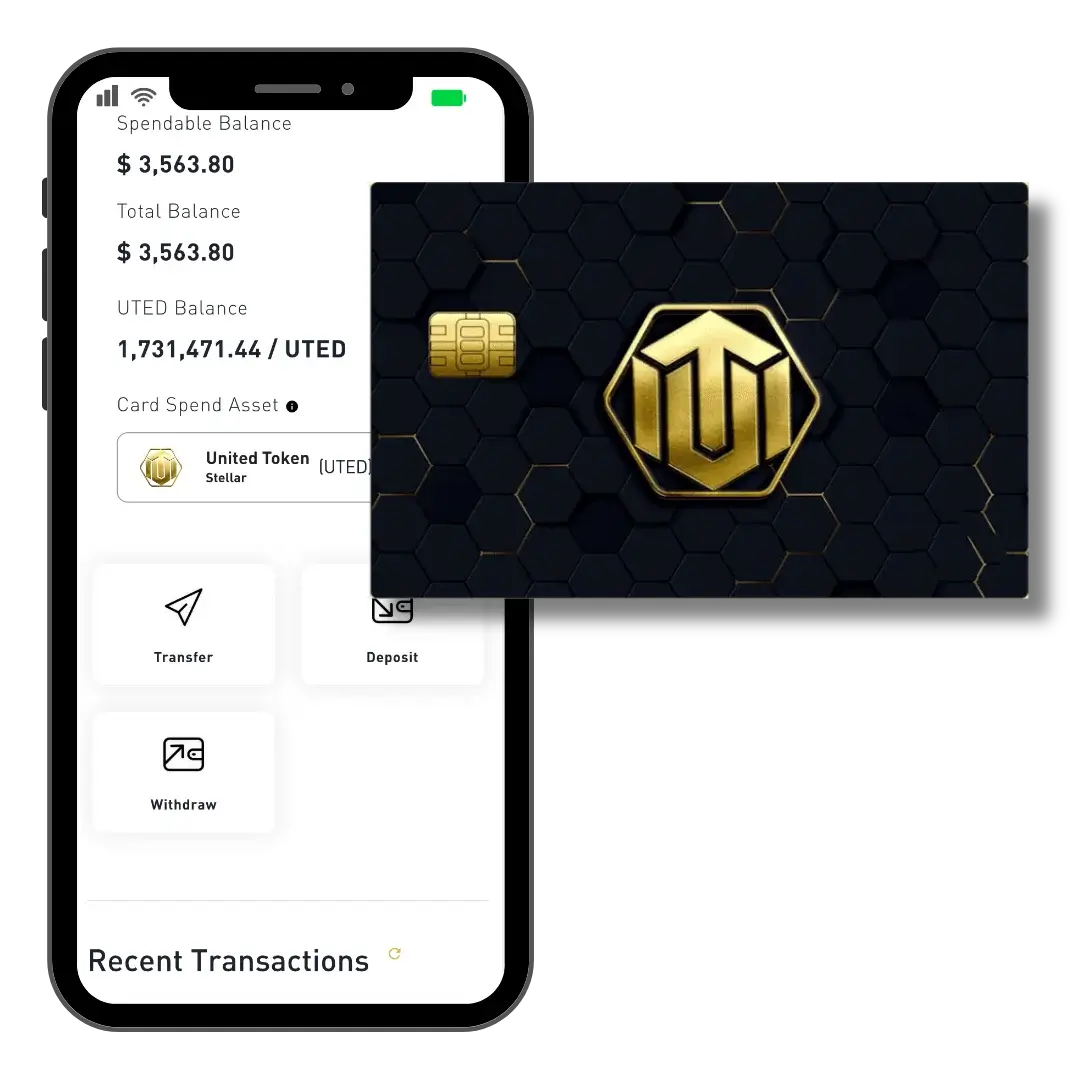

Experience the Enhanced United Card:

Reimagined and Better Than Ever

Are you ready for a game-changing financial journey? We’re thrilled to announce the upcoming relaunch of the United Card, and this time, it’s going to be extraordinary.

Sign up now to be among the first to experience the reimagined United Card.

Unveiling the Phoenix: Soaring to New Heights in our Relaunch, Stronger Than Ever

In just 3 months, we’re introducing an unparalleled experience that will revolutionize the way you manage your finances. We’re raising the bar, setting new standards, and bringing you a card that’s not just about transactions; it’s about empowering your dreams.

Why wait for greatness when you can be part of it from the beginning? Join us on this remarkable journey as we reshape the landscape of financial freedom. Here’s a glimpse of what’s coming:

Unlock the Power of Extraordinary Card Benefits and Unparalleled Support

- Elevated Benefits: Prepare to be amazed by our enhanced benefits package, carefully designed to exceed your expectations. We’ve listened to your feedback and made significant improvements to provide you with even greater value.

- Seamless Digital Experience: Say goodbye to unnecessary complications and hello to a seamless digital experience. Our user-friendly platform will make managing your card effortless, ensuring you have more time to focus on what truly matters to you.

- Exclusive Rewards: Unlock a world of exclusive rewards and privileges tailored to your unique aspirations. From travel perks to lifestyle benefits, we’re dedicated to bringing you unparalleled opportunities to enhance your journey.

- Unmatched Security: Your peace of mind is our top priority. We’ve implemented state-of-the-art security measures to safeguard your transactions and protect your sensitive information. Rest assured, your financial well-being is in safe hands.

- Personalized Support: Our team of dedicated experts is here to provide you with exceptional support every step of the way. We believe in building meaningful relationships and assisting you in achieving your financial goals, no matter how big or small.

How United Crypto Card Works

Unlike most platforms, your funds are held in crypto. We only convert your crypto to fiat at the time of purchase.

Deposit Crypto

Account Balance

Withdraw Cash

UTED is sold for fiat currencies, seamlessly behind the scenes, to enable each transaction, including ATM withdrawals.

Frequently Asked Questions

Where can I use my card?

Your card is a debit card that works wherever major credit cards are accepted. This includes transactions in credit, debit, or at ATMs.

Your card is versatile. You can use your card as “credit”, where you run the card and sign for the purchase. You can also use the card as “debit”, which means that you enter your PIN to make a purchase. You can also use your card at an ATM to withdraw cash. The card can also be used over the phone and online to make purchases.

Getting started — how to deposit, complete KYC, and get your card!

If you have just opened your account, the first step is to complete KYC and make your initial deposit to fund your card. Because this is a prepaid card, it works differently from a credit card — it needs to have a pre-funded starting balance. Your account will show as ‘inactive’ until KYC is completed and your card is activated, and accounts currently require a minimum balance of at least $10 in order to complete the KYC identity verification process (we recommend at least $30-50 to start with to cover the one time $10 KYC & activation fee, and have enough remaining to begin spending right away after that).

All users who meet the minimum balance requirement can click on the “Select Card” link on your account dashboard which will allow you to complete your card application. A virtual card (with full card number and expiration/CVV) will be available immediately in your account dashboard and, if you are receiving a physical card, that physical card is sent to you in the mail, arriving in 7 to 12 business days. Your physical card will have a different card number than the virtual card, but both will draw from the same account balance.

The minimum balance is used to protect your account against the volatility of crypto markets — your card spendable balance is the amount of your balance exceeding $10.

Do I need to deposit before my card will be sent?

Because our card is a prepaid card, it works differently than a credit card for example. Whereas with a credit card you are essentially borrowing funds every time you make a purchase, a debit/prepaid card like ours will draw from your pre-funded balance. So in order to get the card, it needs to have a pre-funded starting balance.

For information on making your first deposit, please see this solutions article.

How do I make my initial cryptocurrency deposit to fund my card?

1. After signing in to your account dashboard, click on Deposit.

2. Select the cryptocurrency you would like to use to fund the account by clicking the image logo.

3. After clicking the image you will be given an address to send your cryptocurrency to. Some type of cryptocurrency also require a tag or memo in addition to the address, so please be careful to note this if it’s present.

4. Copy and paste the address (and memo/tag if applicable) from the modal popup deposit window. Then send the funds from your personal wallet or exchange to this deposit address.

5. Depending on the currency you have selected, funding can take between seconds to hours (during peak times).

I created my account and deposited — when will I receive my card?

Once your KYC authorization is complete and the card has been selected, you can use your virtual card through your account dashboard immediately, and (if applicable) your physical card will arrive within 10 to 12 business days.

What are the fees to use the United Token Card?

We continually work hard to reduce or remove as many fees as possible; however – these fees are mandated by our banking partners. We believe in transparency and does not hide any fees from our customers.

Deposit Fee : $0.00

Transfer Fee : $0.00

Withdraw Fee : $0.00

Activation & Card Fee : $15.00 (virtual) / $20.00 (plastic)

Card Replacement Fee (incl. Lost or Stolen Replacement) : $20.00

Account Closure/Balance Refund Fee : $0.00

Monthly Subscription Fee : $5.00

Signature Transaction Fee (Domestic) : $0.00

ATM/PIN Transaction Fee (Domestic) : $1.50

ATM/PIN Cash Withdrawal Fee (Domestic) : $5.00

ATM/PIN Transaction Fee (Int’l) : $5.00

ATM/PIN Decline Fee (Int’l) : $0.50

ATM Balance Inquiry Fee : $0.50

Foreign Transaction Fee (ATM/PIN) : $1.50

*Fees are subject to change at any time.

What are the different card types/options available?

Generally speaking, you will receive a virtual card after KYC/activation and it will be available on your account dashboard homepage. If a physical card is also offered and you have selected this option, it will arrive in the mail in 7 to 12 business days.

What information and documents are required for KYC identity verification?

Our banking partners have their own KYC criteria and the required documents will be requested when you begin the process — in the United States for example, you can complete the process with your Social Security Number and either your Passport or Driver’s License number. Documentation must meet their standards based on your local country and government laws. If you do not pass KYC the first time, you may automatically enter a manual review process where we may request additional documentation in order to complete the process. If this is the case you will be contacted by our customer support team automatically.

What if I need to update my billing address after I have already completed KYC?

If you have already completed KYC and you need to specify a new billing address because of a move, or a new shipping address, please contact customer support through the Support page on your account dashboard. Thank you.

Where is the card available globally, and who can enroll?

Initial rollout occurred in the United States, followed by the rollout in Europe and coming to Latin America. Availability in your specific area is based on the program you signed up with.

Eligibility is subject to local laws and will typically require residency with a valid government issued ID and a verifiable address to open a card account. Some specific regions are not supported, including United States territories such as Puerto Rico, Guam, Virgin Islands, American Samoa or other U.S. territories.

Can I enroll using a business name?

Can I have multiple cards?

When does my card expire?

Is there a fee for card account termination?

I returned a purchase I made using my card — how long does it take for the funds to go back on my card?

Can I use my card at ATMs to withdraw cash?

You can withdraw cash from almost any ATM worldwide (local restrictions may apply).

I sent a cryptocurrency deposit to my card, but don’t see funds in my account. What should I do?

If you have made a cryptocurrency deposit to your card balance and it has not processed yet, please be patient — depending on the type of cryptocurrency involved in the transaction, it may take up to 24 hours for that transaction to fully confirmed and your account balance to be updated.

If more than 24 hours have passed and you are still not seeing the results of your transaction:

- Double check to make sure that the transaction was sent to the correct wallet address.

- Verify that the transaction was completed via the blockchain ledger (transaction history) for that cryptocurrency.

- If you are making a deposit by sending a type of cryptocurrency that requires a memo or tag, please check your transaction and verify that you included both the destination address and required memo or tag.

You can also submit a ticket to our support team under the support menu of your account dashboard. When contacting support, please send us any details about the transaction you have made to or from your account, including reference records/numbers if possible. This will help our team quickly resolve your issue.

How do I view my card account activity?

You can view all transactions and manage all of your account information from your account dashboard. The Transactions menu on your account dashboard will show you the complete history of deposits, withdrawals, transfers, and transactions you’ve made on the card.

How long does it take for a deposit to complete and arrive in my account?

Card deposits generally take between just a few seconds to a few hours depending on the cryptocurrency asset type you are depositing, the level of congestion that the asset network is facing at that time, and the time needed for security processing including reaching the required number of confirmations. (For example, a BTC or LTC deposit typically takes longer than an XLM deposit.) Deposit processing should never exceed 24 hours. If you have verified your deposit on the blockchain and it still has not been reflected in your account after 24 hours, please let us know and we will look into it and resolve the issue.

What is the minimum and maximum amount of money that I can deposit to my card balance?

Your card account balance currently requires a minimum balance of at least $10 in order to complete the KYC identity verification process (we recommend at least $30-50 to start with). You must also keep a minimum balance of $10 in your account. When your balance dips below $10 you will need to replenish funds in order to keep using your card.

There is no maximum that you can deposit them – can deposit as much as you want. In the US, your cards (virtual and physical) will allow you to spend $5,000 a day, for a combined amount of $5,000 per day in point-of-sale transactions; cash or cash equivalent transactions are limited to $500 per day. In the UK and EEA, your cards (virtual and physical) will allow you to spend 3000 EUR/GBP in a single transaction, 5000 EUR/GBP per day, and up to 10,000 EUR/GBP every 30 days; cash or cash equivalent transactions are limited to 500 EUR/GBP per day and 2500 EUR/GBP every 30 days.

Where can I find the destination address (and memo/tag) I need in order to deposit cryptocurrency to my account?

You can find the cryptocurrency accepted for deposit, and associated destination address, under the deposit menu on your account dashboard. Importantly, please check the deposit popup window to see if your deposit address is accompanied by a required memo or tag that will be unique to your account; and, if present, please remember to always include the memo when you deposit this crypto. The pop-up window will also include the minimum deposit amount for depositing the cryptocurrency, if applicable.

Can I deposit by loading funds directly to the card at retail stores?

Yes, you can if you are US cardholder. You can make a deposit by directly loading funds onto the card at retail stores by visiting one of our Visa ReadyLink partners such as Walgreens, CVS, 7-Eleven, CIrcle K, and many others. When you do, simply visit the cashier or self-serve kiosk, load your funds and go. For more information and to look up locations near you please visit the Visa ReadyLink website.

Can I withdraw cryptocurrency directly from my card account balance?

When I deposit cryptocurrency, how do network fees affect my deposit amount?

Depending on the type of cryptocurrency that is deposited, the crypto network itself will charge a fee for the transaction, and any cryptocurrency that is deposited is moved internally for further processing. For example, if you were to deposit 0.005 Bitcoin, the final deposit amount might be 0.0049 after 0.0001 was to paid to the bitcoin miners for the internal transaction. (This is just an example and is subject to change for Bitcoin or any other network — transaction fees will change depending on network activity.). In this example, 0.0049 BTC would be the credited deposit value.

The network fee is not a fixed percentage of the amount, as the blockchain transaction cost is not based on the transaction amount. So it is typically advantageous to deposit larger amounts or make one deposit with the full intended amount rather than several smaller deposits. Furthermore, by using a blockchain with low transaction costs (like Stellar) for deposits, this kind of fee can be avoided.

How do I complete identity verification and pass KYC?

The network fee is not a fixed percentage of the amount, as the blockchain transaction cost is not based on the transaction amount. So it is typically advantageous to deposit larger amounts or make one deposit with the full intended amount rather than several smaller deposits. Furthermore, by using a blockchain with low transaction costs (like Stellar) for deposits, this kind of fee can be avoided.

My card has been suspended due to negative balance, how can I get it re-activated?

How do I update my account with a change of address?

Are bitcoin cash deposits still supported after the BCH hard fork on November 15?

When I swipe my card at a gas pump I get charged $50 – $150 even if I only pump $10.00 worth of gas. Why?

Sign up now to be among the first to experience the reimagined United Card.

“Please note that the subject of our campaigns may be changed by us without prior consent. We reserve the right to modify our campaign topics at any time, without notice. By participating in our campaigns, you acknowledge and accept that we may alter the subject matter of the campaign at our discretion.”